Financial Modelling Fundamental using Excel

Course Objectives

Upon the completion of this Financial Modelling Fundamental using Excel course, participants should be able to:

- understand the difference between a financial model and a spreadsheet

- understand various types and purposes of financial models

- understand the skills to acquire to be a good financial modeller

- understand and apply financial modelling best practices

- use Excel functions, features, and objects frequently used in financial modelling

- use Excel keyboard shortcuts

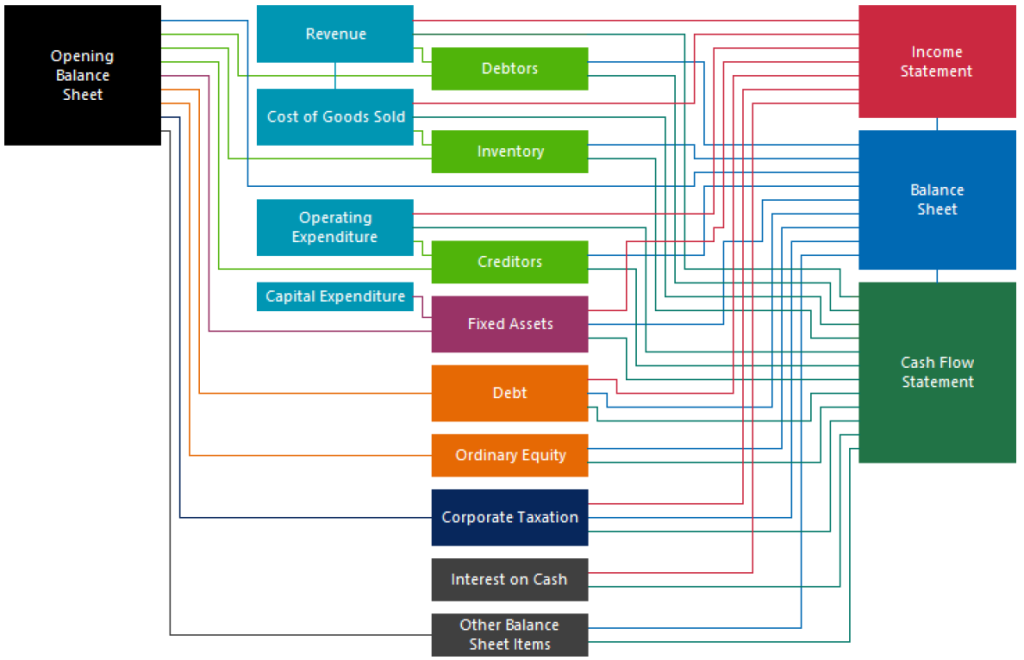

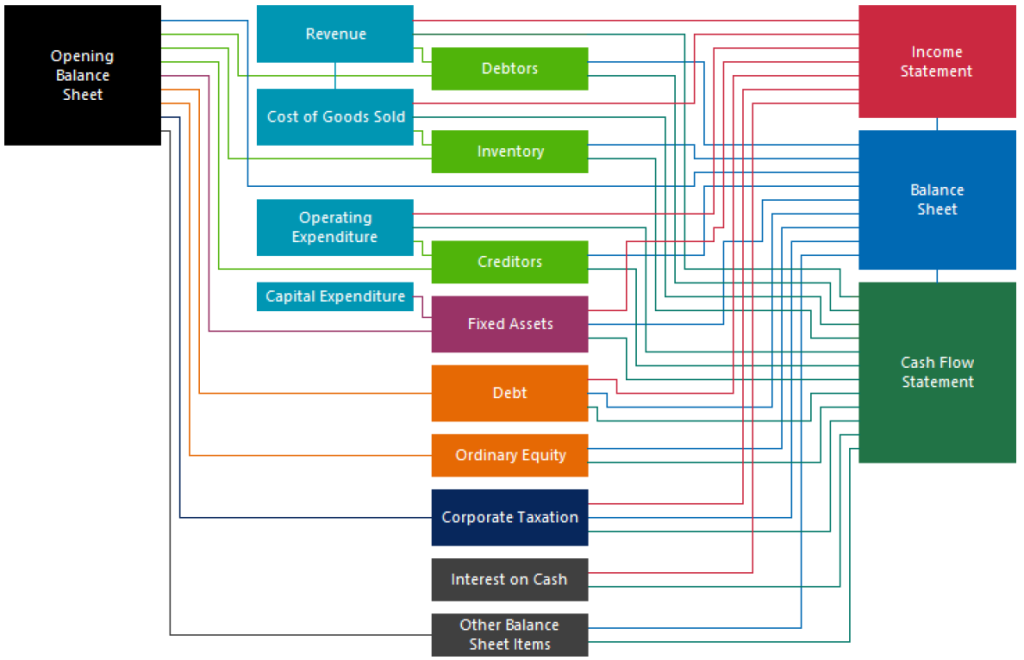

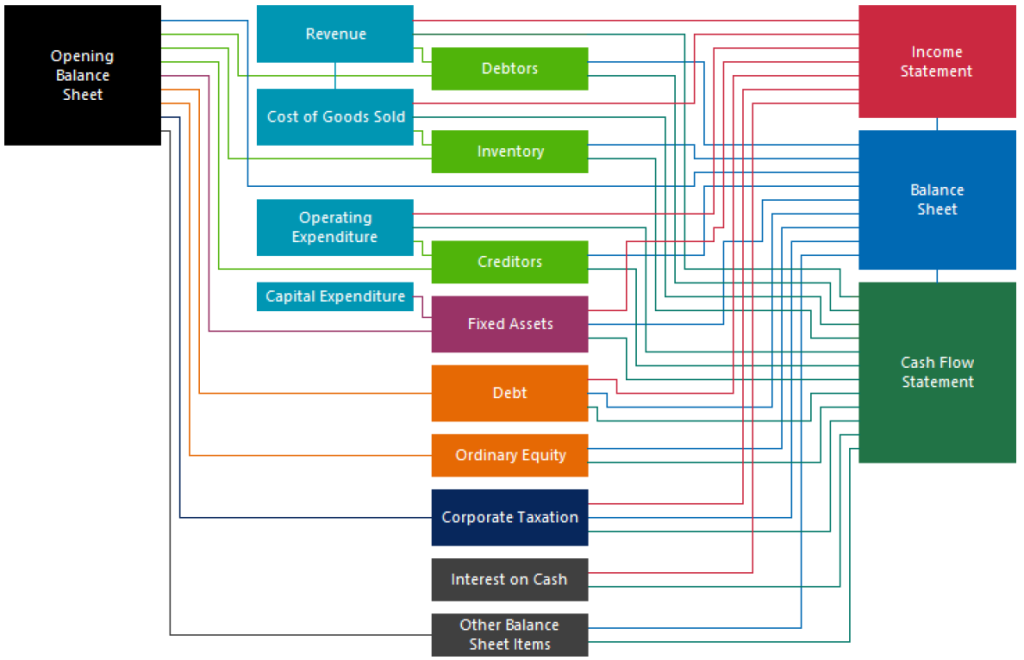

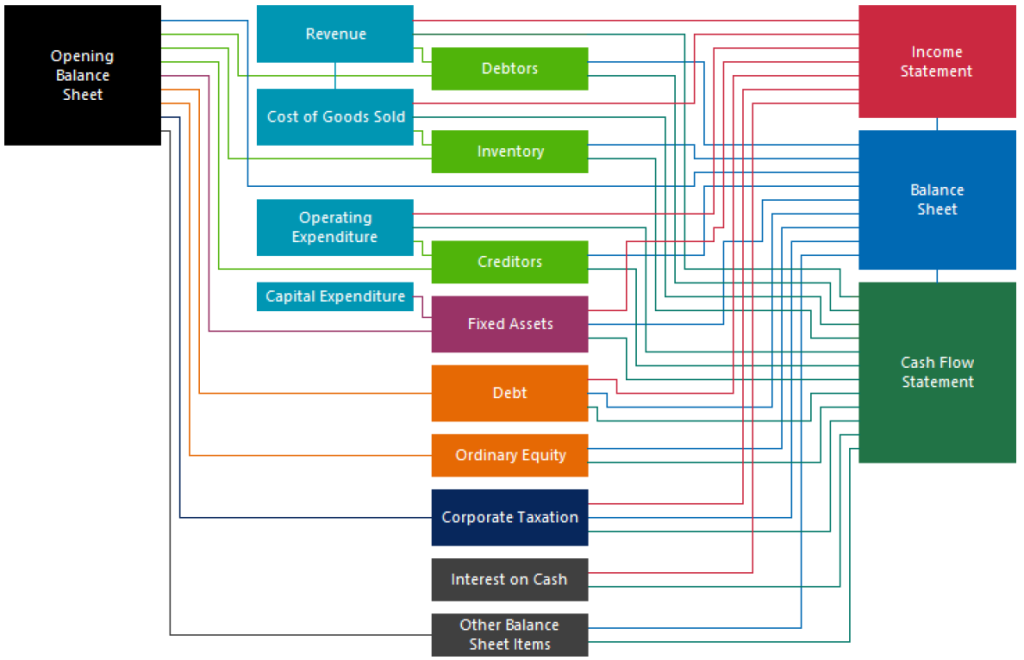

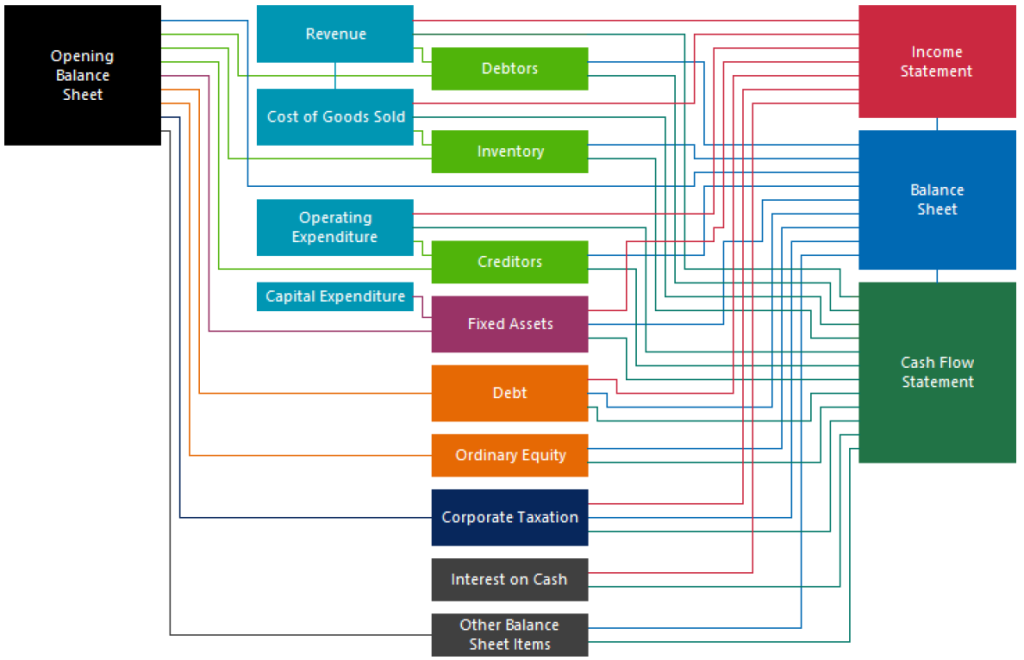

- build a 3-way financial projection model (income statement, balance sheet, cash flow statement) and financial ratios

- build a dynamic chart for financial ratios

- build sensitivity and scenario analysis functionality

- build model error checks to maintain financial model integrity

- build model navigation for ease of model use

Workshop Trainer

Purwadi Nitimidjojo

The trainer, started his financial modelling career in early 2005 after working for Indonesian Bank Restructuring Agency (IBRA / BPPN) during the monetary crisis from 1998 through 2004. At IBRA’s Credit Risk Management Division he developed various financial models for debt restructuring and corporate restructuring and learned that most of IBRA’s large debtors hired foreign financial consultants to develop financial models as they didn’t have any resources who could develop proper financial models, and financial modelling training courses were not available back then. This is when he saw an opportunity to deliver financial modelling training courses and develop best-practice financial models for clients in various industries in Jakarta.

In early 2005 Purwadi teamed up with two of his friends and used “Edward, Farral & Peterson” and “Edward & Peterson” as their brands to provide monthly public training courses and financial modelling services until early 2012 before he was hired by Deloitte Financial Advisory as a Financial Modelling Director to do the same. At Deloitte he and his financial modelling team developed best-practice financial models for his clients in various industries for various purposes and delivered monthly financial modelling and Power BI training courses for the public, clients, and Deloitte’s internal staff in Indonesia, Singapore, Malaysia, Thailand, and Cambodia.

After spending 10 years working for Deloitte, he returned to his own financial modelling business and is now working as a financial modelling subcontractor for BDO and Deloitte as well as an independent private financial modelling consultant and trainer.

Baca Juga: Data Analysis & Visualization with Power BI

Schedule

30-31 January 2025, 09.00-17.00 wib

Venue

Swiss-Belhotel Pondok Indah, Jakarta Selatan

Jl. Metro Pondok Indah Sector 2 Block SA, Pondok Indah, Jakarta Selatan

Course Outline

Note: Contact us for more info about details Syllabus & Investment Fee

Baca Juga: Financial Modeling Data Process, Analysis & Visualization

Frequently Asked Questions

- Who Should Attend This 2-Day Fully Hands-On Course?

- This course is designed for beginners or those who need to refresh their financial modelling skills.

- What are the Prerequisites for Participants?

- Participants are expected to have accounting & finance knowledge and be familiar with basic Excel functions and features.

- How is the Course Delivered?

- In-house or in public; live (in-person) only.

- How Many Hours per Day Does It Last?

- The course duration is 8 hours per day, usually from 9.00 am to 5.00 pm.

- What are the Minimum and Maximum Number of Participants per Classroom If Delivered In-House?

- No minimum number, but the maximum number is 20 participants.

Note: Contact us for more info about details Syllabus & Investment Fee

Baca Juga: Financial Modeling Data Process, Analysis & Visualization

Frequently Asked Questions

- Who Should Attend This 2-Day Fully Hands-On Course?

- This course is designed for beginners or those who need to refresh their financial modelling skills.

- What are the Prerequisites for Participants?

- Participants are expected to have accounting & finance knowledge and be familiar with basic Excel functions and features.

- How is the Course Delivered?

- In-house or in public; live (in-person) only.

- How Many Hours per Day Does It Last?

- The course duration is 8 hours per day, usually from 9.00 am to 5.00 pm.

- What are the Minimum and Maximum Number of Participants per Classroom If Delivered In-House?

- No minimum number, but the maximum number is 20 participants.

Note: Contact us for more info about details Syllabus & Investment Fee

Baca Juga: Financial Modeling Data Process, Analysis & Visualization

Frequently Asked Questions

- Who Should Attend This 2-Day Fully Hands-On Course?

- This course is designed for beginners or those who need to refresh their financial modelling skills.

- What are the Prerequisites for Participants?

- Participants are expected to have accounting & finance knowledge and be familiar with basic Excel functions and features.

- How is the Course Delivered?

- In-house or in public; live (in-person) only.

- How Many Hours per Day Does It Last?

- The course duration is 8 hours per day, usually from 9.00 am to 5.00 pm.

- What are the Minimum and Maximum Number of Participants per Classroom If Delivered In-House?

- No minimum number, but the maximum number is 20 participants.

- What is Financial Modelling?

- Types and Purposes of Financial Models

- What Skills Do You Need to Be a Good Financial Modeller?

- Financial Modelling Best Practices

- Excel Skills – Model Building Toolbox

- Modelling Financial Statement Inputs

- Modelling Calculations

- Modelling Financial Statement Outputs

Note: Contact us for more info about details Syllabus & Investment Fee

Baca Juga: Financial Modeling Data Process, Analysis & Visualization

Frequently Asked Questions

- Who Should Attend This 2-Day Fully Hands-On Course?

- This course is designed for beginners or those who need to refresh their financial modelling skills.

- What are the Prerequisites for Participants?

- Participants are expected to have accounting & finance knowledge and be familiar with basic Excel functions and features.

- How is the Course Delivered?

- In-house or in public; live (in-person) only.

- How Many Hours per Day Does It Last?

- The course duration is 8 hours per day, usually from 9.00 am to 5.00 pm.

- What are the Minimum and Maximum Number of Participants per Classroom If Delivered In-House?

- No minimum number, but the maximum number is 20 participants.

- What is Financial Modelling?

- Types and Purposes of Financial Models

- What Skills Do You Need to Be a Good Financial Modeller?

- Financial Modelling Best Practices

- Excel Skills – Model Building Toolbox

- Modelling Financial Statement Inputs

- Modelling Calculations

- Modelling Financial Statement Outputs

Note: Contact us for more info about details Syllabus & Investment Fee

Baca Juga: Financial Modeling Data Process, Analysis & Visualization

Frequently Asked Questions

- Who Should Attend This 2-Day Fully Hands-On Course?

- This course is designed for beginners or those who need to refresh their financial modelling skills.

- What are the Prerequisites for Participants?

- Participants are expected to have accounting & finance knowledge and be familiar with basic Excel functions and features.

- How is the Course Delivered?

- In-house or in public; live (in-person) only.

- How Many Hours per Day Does It Last?

- The course duration is 8 hours per day, usually from 9.00 am to 5.00 pm.

- What are the Minimum and Maximum Number of Participants per Classroom If Delivered In-House?

- No minimum number, but the maximum number is 20 participants.